Liquidating a company’s inventory can be a difficult process, but it’s often necessary in order to stay afloat financially.

Business owners should prepare for inventory liquidation by ensuring they have a plan in place for how they will sell their inventory. This includes setting a price for the inventory and determining where they will sell it.

It is important for business owners to prepare for inventory liquidation because it can help them avoid bankruptcy or financial ruin. By selling off their inventory quickly, they can raise cash to pay off debts or invest in new products. Additionally, failing to sell inventory in a timely manner can lead to losses due to depreciation or obsolescence.

Preparing for inventory liquidation during the financial year end involves creating a plan for how to sell the inventory, determining the appropriate discounts, and communicating with customers and suppliers. It may also involve working with a liquidation specialist or a consultant to ensure that the process is executed efficiently and effectively.

Here are some items that could be included in a Checklist for preparing inventory liquidations during financial year-end

Determine the Value of Inventory

Calculate the value of your inventory by using the appropriate valuation method (e.g., FIFO, LIFO, or weighted average). This information will help you to determine the expected proceeds from the liquidation.

Evaluate Obsolete and Slow-Moving Inventory

Identify any obsolete or slow-moving inventory that may be difficult to sell during the liquidation. Consider discounting or disposing of these items before the liquidation to avoid incurring additional costs.

Review Contracts and Agreements

Review any contracts or agreements related to the inventory, such as vendor agreements, purchase orders, and consignment agreements. Make sure you understand your obligations and rights related to the liquidation of the inventory.

Determine the Sales Channel

Determine the sales channel that you will use to sell the inventory. Consider selling through online marketplaces, auctions, or liquidation companies, and evaluate the fees and commissions associated with each option.

Prepare the Inventory

Prepare the inventory for sale by packaging it, labelling it, and arranging it in a way that is easy to sell. Consider taking photographs and creating product descriptions to use in the sales process.

Develop a Marketing Plan

Develop a marketing plan to promote the inventory sale. Consider using email marketing, social media, and targeted advertising to reach potential buyers.

Monitor the Liquidation

Monitor the liquidation process closely to ensure that the inventory is selling as expected. Adjust your marketing and sales strategies as needed to maximize the proceeds from the liquidation.

Finalize the Sale

Finalize the sale by closing out the inventory account and recording the proceeds from the liquidation in your financial statements.

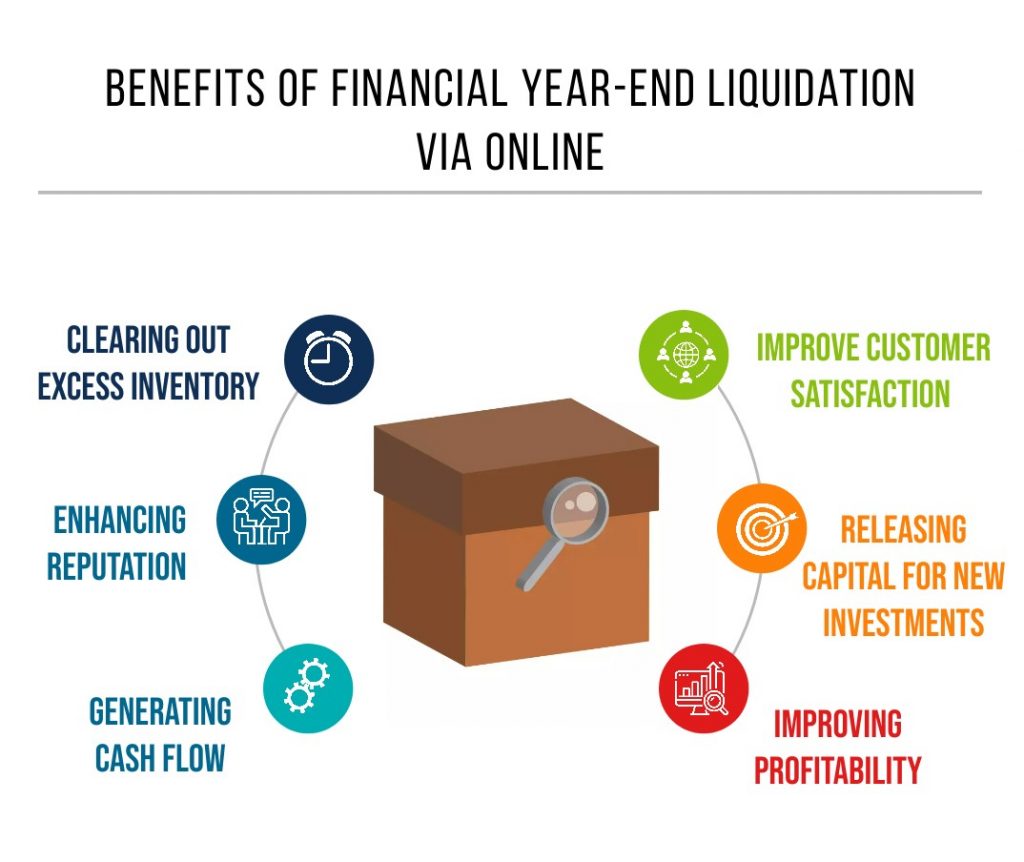

Inventory liquidation during the financial year-end can offer several advantages to business owners.

- By liquidating excess or slow-moving inventory, business owners can free up cash flow that was tied up in inventory. This can help improve the company’s financial position and provide funds to reinvest in the business or pay off debt.

- Liquidating inventory at discounted prices can help generate revenue and increase profitability for the business. It can also help reduce storage and carrying costs associated with holding excess inventory.

- Liquidating inventory can help improve the turnover rate of inventory. This means that inventory is sold more quickly and efficiently, which can help increase revenue and reduce carrying costs.

- Liquidating old or slow-moving inventory can create space for new inventory. This can help businesses to stay current with trends and meet customer demands.

- Offering discounted prices and promotions during an inventory liquidation sale can help attract new customers and strengthen relationships with existing customers. This can lead to increased customer loyalty and future sales.

- Analyzing sales data and customer behavior during an inventory liquidation sale can provide valuable insights into which products are in demand and which ones are not. This information can help business owners make informed decisions about future inventory purchases and sales strategies.

Overall, inventory liquidation can be a powerful tool for improving a business’s financial position, increasing profitability, and strengthening customer relationships. It is important, however, to carefully plan and execute an inventory liquidation sale to ensure that it is effective and maximizes the benefits for the business.

Efficient inventory liquidation before the financial year

For an effective inventory liquidation process prior to the financial year, it is important for businesses to conduct regular reviews of inventory levels and sales data, create a sales strategy, use inventory management tools, optimize supply chain management, and have a contingency plan. These measures can lower the likelihood of needing to liquidate inventory at the end of the financial year, leading to better cash flow and reduced financial losses.

Closure

Preparing for financial year inventory liquidations is crucial for business owners to ensure a successful end of the financial year. By reviewing inventory levels, planning for markdowns, checking expiration dates, evaluating suppliers, optimizing storage, monitoring sales, and preparing for tax implications, business owners can effectively manage their inventory and maximize profits. This checklist can helpful for business owners to prepare for inventory liquidations and make the most out of their end-of-financial-year sales.